Your Meta Ads dashboard shows a 3.2 ROAS. Google Shopping is at 4.1x. Revenue is steady. Everything looks fine.

So why does it feel like you’re trapped?

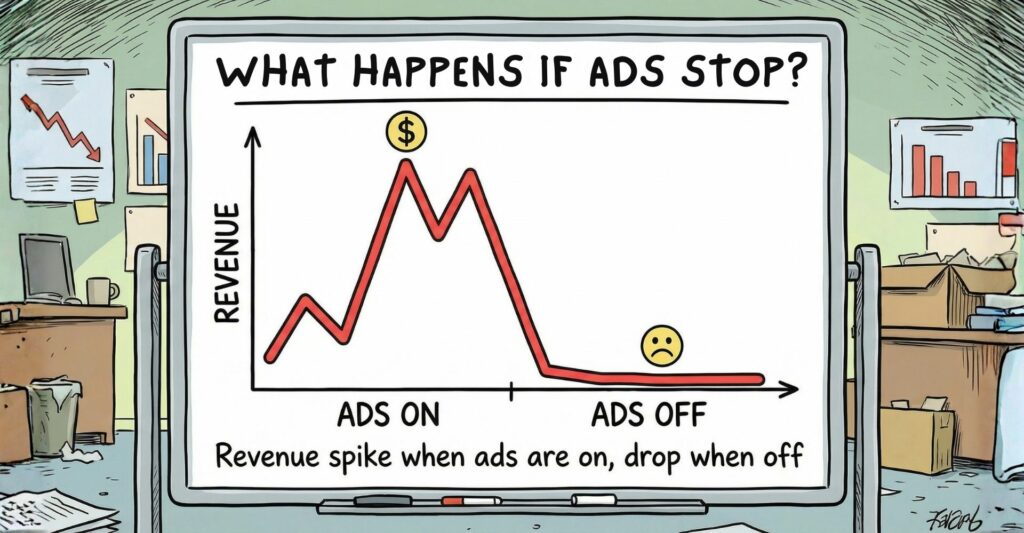

You try to scale spend, and efficiency drops. You pause ads for a week to save budget, and revenue falls off a cliff. You’re hitting your targets, but profit isn’t growing the way it should.

This is the hidden ceiling most online stores hit between $50K and $500K per month in ad spend. The numbers look healthy until you realize you can’t grow without them, can’t afford to lose them, and can’t seem to push past them.

That’s not a performance problem. That’s a dependency problem.

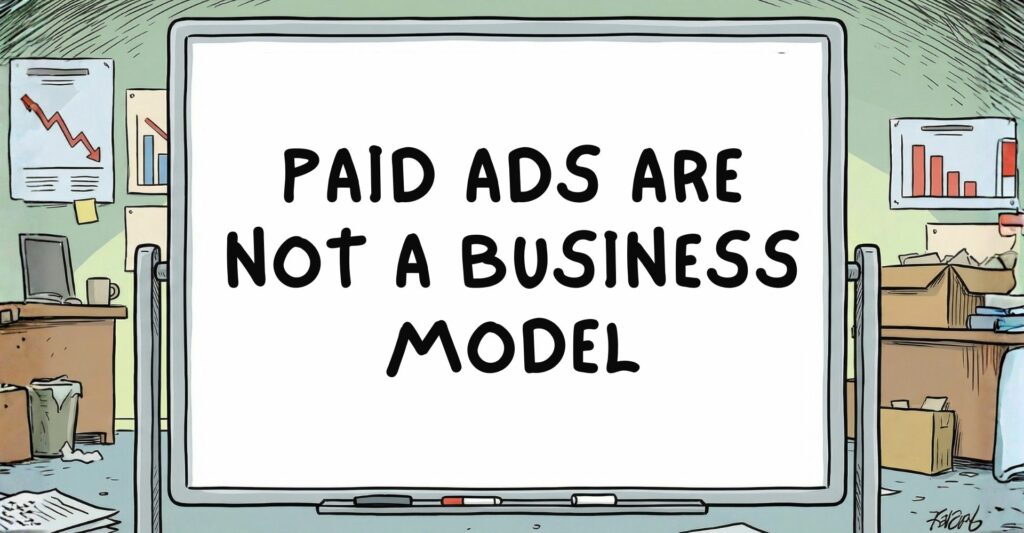

When “Working” Ads Become a Risk

Paid ads are designed to scale businesses. For many stores, they do exactly that…at first. You launch campaigns, dial in your targeting, find winning creatives, and revenue starts flowing. It’s fast, measurable, and feels like you’ve cracked the code.

But somewhere along the way, the relationship flips. Instead of ads supporting growth, they become the only source of it. You’re no longer using paid traffic to accelerate, you’re using it to survive.

Here’s what that looks like in practice:

- You can’t take a month off from ad spend without revenue collapsing

- Profit margins shrink every quarter even though ROAS holds steady

- You’re spending more each month just to maintain last month’s revenue

- One campaign pause or account issue creates an immediate cash flow problem

When this happens, you’re not scaling. You’re paying rent.

And the cost of that rent keeps going up. Customer acquisition costs for e-commerce have increased by 40% between 2023 and 2025, driven by rising competition, platform changes, and privacy restrictions that make targeting less precise. What used to cost you $30 per customer now costs $42 and that gap compounds every month you stay on the treadmill.

What Changed: Meta’s Andromeda and the New Ad Reality

If your Meta Ads felt different in late 2024, you weren’t imagining it. Meta rolled out Andromeda, a complete overhaul of how ads get delivered on Facebook and Instagram.

Andromeda is a new retrieval engine that uses deep learning to match individual users with specific ad creatives in real time. According to Meta’s engineering team, the system represents a 10,000x increase in model complexity compared to what they were using before, and it fundamentally changes how advertisers need to operate.

What changed:

Before Andromeda, you controlled targeting. You’d build audiences based on interests, behaviors, demographics, and let Meta show your ads to those groups. The algorithm optimized within the parameters you set.

Now, Meta controls which ad each person sees. Andromeda reads your creative, visuals, copy, tone, format, and uses those signals to determine relevance. Your job isn’t to tell Meta who to target. It’s to give Meta enough creative diversity that it can find the right people on its own.

What this means for ad dependency:

Creative fatigue happens faster. Where an ad might have run profitably for 4-6 weeks before, it now burns out in 2-3 weeks. If you’re not producing new creative consistently, performance drops hard.

Costs fluctuate more. Andromeda prioritizes creative diversity. If your account has high “creative similarity,”meaning your ads look too much alike, the system raises your CPMs as a penalty. Stores that were running 3-5 ads per campaign are now seeing worse results than those running 15-20 diverse creatives.

Attribution gets messier. With Andromeda optimizing at the individual level, it’s harder to tell why something worked. Tools like Triple Whale and Hyros help, but the reality is you need more volume and faster iteration to keep up.

The Scaling Paradox: Why Doubling Spend Doesn’t Double Profit

One of the most frustrating realizations for store owners is that paid ads don’t scale linearly.

When you’re spending $5K/month and getting a 4x ROAS, it’s tempting to think, “If I just spend $50K/month, I’ll 10x my revenue.” But that’s not how it works.

Audience saturation. Your best customers, the ones most likely to convert, see your ads first. As you scale, Meta moves into broader, colder audiences. These people cost more to convert and have lower lifetime value. Your blended ROAS might stay at 3x, but the quality of that 3x deteriorates.

Creative fatigue. The ads that were printing money at $10K/month start to wear out at $30K/month. Frequency climbs. Click-through rates drop. You’re paying more per impression for worse engagement. If you don’t have a system to produce and test new creative, performance degrades before you even notice.

Margin compression. Let’s say your AOV is $85 and your contribution margin after COGS is 60%. At a $25 CPA, you’re profitable. But as you scale and CPAs drift to $35, then $40, your profit per order shrinks. Revenue grows, but profit doesn’t grow proportionally, or at all.

Platform volatility. The more you spend, the more exposed you are to things you can’t control. iOS updates. Policy changes. CPM spikes during Q4. One week of underperformance at $50K/month in spend is a very different problem than one week at $5K/month.

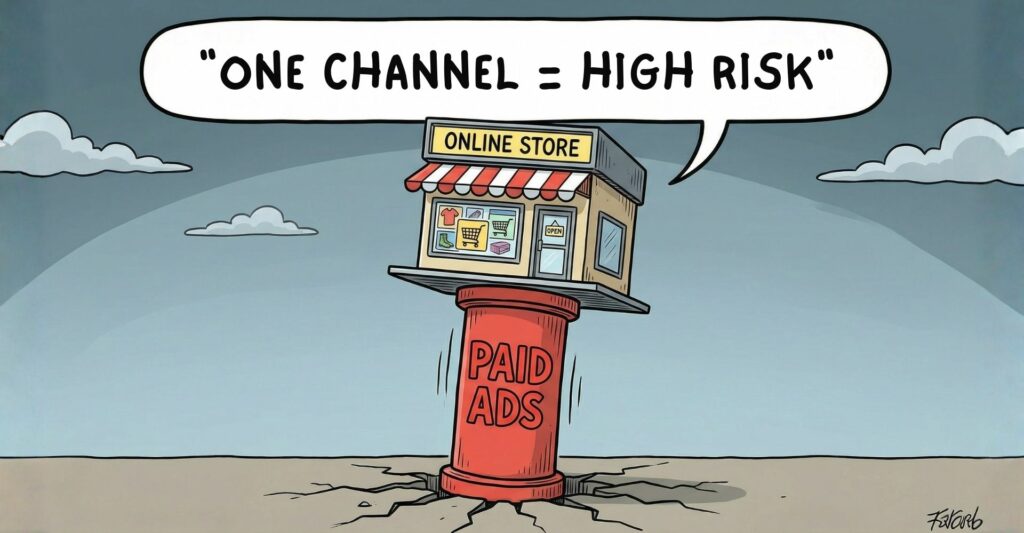

Why One Traffic Source Can Be a Single Point of Failure

When 70%+ of your revenue comes from paid ads, you’re exposed to risks you don’t control:

Platform risk. Meta changes the algorithm. Google updates its policies. Your account gets flagged for review and campaigns pause for three days. TikTok changes its data sharing rules. Any of these can cut revenue in half overnight.

Market risk. Your competitors start spending more. CPMs rise across your industry. A new brand launches with venture funding and floods the auction. Suddenly your $30 CPA becomes $50, and your unit economics break.

Attribution risk. iOS privacy changes have made this even worse. Since Apple’s App Tracking Transparency launched in 2021, roughly 95% of U.S. users opt out of tracking.The attribution window for conversions has been shortened to just seven days, and conversions you used to see now disappear into “direct” or “organic” traffic. You’re still spending the same amount, but now you can’t prove what’s working.

Creative risk. Your best-performing ad stops working. You don’t have a pipeline to replace it. Performance drops 40% while you scramble to test new concepts. If you don’t have a system for creative production, you’re always one fatigued ad away from a bad month.

None of this means paid ads are bad. It means relying on only paid ads is fragile.

Compare that to a store that gets 40% of revenue from paid ads, 30% from organic search, 20% from email, and 10% from organic social. If Meta has a bad week, the business doesn’t panic. If Google CPCs spike, they adjust without bleeding out. They have options.

Diversification isn’t about abandoning paid ads. It’s about reducing the cost of failure.

What Reduces Dependence Without Killing Growth

The goal isn’t to stop running ads. The goal is to build other channels that support and stabilize growth so paid ads can do what they’re actually good at…accelerating demand, not creating it from scratch every single day.

Here’s what that looks like:

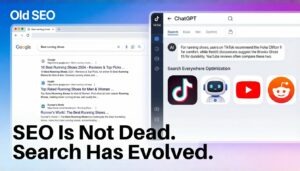

SEO: Demand That Doesn’t Disappear When You Pause Spend

Organic search is the most durable traffic source for e-commerce. Once you rank for high-intent keywords, product names, category terms, problem-solution queries, that traffic keeps coming whether you’re spending on ads or not.

A store selling ergonomic office furniture ranked for “best standing desk under $500” and started getting 2,000 visits per month from that one keyword. That’s traffic they didn’t have to buy. It converts at 4-5%, costs nothing after the initial investment, and compounds over time.

Strong product pages, category pages, and blog content that answers real customer questions builds a moat. It takes longer than paid ads, but it doesn’t evaporate the second you pause a campaign.

Email and SMS: Turning One-Time Buyers Into Repeat Customers

If you’re spending $40 to acquire a customer and their first purchase is $75, you’re not really profitable until they buy again. Retention is where the actual profit lives.

Research shows that acquiring new customers can be 5 to 25 times more expensive than keeping an existing one, yet most brands still allocate the majority of their budget to acquisition instead of retention.

Email and SMS let you re-engage customers without paying acquisition costs. A well-built post-purchase flow can drive 15-25% of customers to a second purchase within 60 days. That turns a break-even first order into a profitable customer relationship.

Repeat buyers have higher AOV, lower return rates, and better LTV. The more revenue you generate from people who already know you, the less pressure you put on paid ads to do all the heavy lifting.

We worked with an activewear brand that was doing $200K/month, 80% from paid ads. We helped them build out email flows and a regular campaign calendar. Within four months, email was driving 22% of revenue. That didn’t replace paid ads—it reduced how much they needed ads to hit their targets.

CRO: Making the Same Traffic Worth More

If your conversion rate is 2% and you improve it to 2.8%, you just increased revenue by 40% without spending an extra dollar on ads. That’s the leverage of conversion rate optimization.

According to Shopify’s research, making your website just one second faster can lead to a 7% rise in conversions, and ensuring your site loads in two seconds or less can increase conversions by 15%. The average e-commerce conversion rate in 2025 hovers between 2% and 4%, which means most stores have significant room for improvement.

Small changes compound:

- Clearer product images and better descriptions

- Faster load times (especially on mobile)

- Simpler checkout with fewer form fields

- Trust signals like reviews, testimonials, guarantees

- Sticky add-to-cart bars and exit-intent offers

One brand we worked with was getting 50,000 visitors per month from paid ads at a 1.9% conversion rate. We tightened up their product pages, simplified checkout, and added reviews. Conversion rate hit 2.6%. Same traffic, 37% more revenue. Suddenly their ad spend went a lot further.

Brand: Lowering CPAs Over Time

This one’s harder to measure, but it’s real. When people recognize your brand, they’re more likely to click your ad, more likely to convert, and less likely to bounce.

Branded search traffic converts at 5-10x the rate of cold traffic. If 30% of your paid ad clicks are from people who’ve heard of you before—through word of mouth, PR, influencers, organic social—you’re paying acquisition costs for warm traffic. That’s a better deal.

Building a brand doesn’t mean running Super Bowl ads. It means showing up consistently, having a distinct point of view, and creating reasons for people to talk about you outside of your ad campaigns.

The stores that invest in brand see their CAC drop over time while competitors’ costs keep climbing.

How Sustainable Stores Use Paid Ads

The most profitable stores we work with treat paid ads as an accelerator, not a foundation.

They use Meta and Google to:

- Capture high-intent demand (people searching for their products)

- Amplify launches and promotions

- Test new products and messaging quickly

- Scale what’s already working organically

But they don’t rely on ads to generate all their demand.

Here’s what their growth mix typically looks like:

- 40-50% from paid ads

- 25-35% from organic search

- 15-20% from email and SMS

- 5-10% from organic social, referrals, direct

When a campaign underperforms, they adjust calmly. When Meta changes the algorithm, they adapt without panic. When CPMs spike in Q4, they lean into email. They have options.

That balance doesn’t happen by accident. It’s the result of deliberately building multiple channels instead of optimizing a single one to death.

What 2026 Looks Like for Ad-Dependent Stores

Let’s be direct… paid ads are not getting easier or cheaper.

Meta’s Andromeda update is pushing advertisers toward higher creative volume and faster iteration. Stores that can’t keep up will see costs rise and performance degrade.

Google is leaning harder into automation and Performance Max, which means less control and more trust in the black box. If your account structure is messy or your product feed is weak, you’ll get punished.

According to recent data, Google’s average cost-per-click increased by 10% from 2023 to 2024, with industries like apparel and fashion seeing CPCs rise by 24.6% year-over-year. This trend shows no signs of slowing.

TikTok, Amazon, YouTube, every platform is building more sophisticated ad systems that reward the advertisers who can move fast, test smart, and feed the algorithm what it needs.

Competition isn’t shrinking. More brands are spending more money. CPMs will keep climbing. The only way to maintain efficiency is to get better at creative, better at testing, and better at building channels that don’t require you to pay for every single visitor.

The stores that survive are the ones that treat paid ads as one part of a system, not the system itself.

The One-Month Test

Here’s a simple way to know if you have a dependency problem:

Could your business survive one month without paid ads?

Not thrive…survive. Could you cover payroll, fulfill orders, and keep the lights on if you paused all ad spend for 30 days?

If the answer is no, you’re not running a business with paid ads. You’re running paid ads with a business attached.

That’s a risk worth addressing now, before a platform change, policy update, or budget crunch forces your hand.

Final Thoughts

Paid ads are powerful. When they work, they work fast. But power without balance creates fragility.

The smartest e-commerce stores in 2026 won’t be the ones spending the most on ads. They’ll be the ones who’ve built systems where ads amplify organic demand, where email handles retention, where SEO brings in traffic that doesn’t disappear when budgets tighten.

That’s not slower growth. That’s safer, more profitable, more sustainable growth.

If you’re ready to reduce your dependence on paid ads without sacrificing revenue, that’s exactly what we help stores do. We don’t just run campaigns, we build growth systems that work whether ad costs go up, down, or sideways.

Book a discovery call and let’s talk about what a balanced growth strategy looks like for your store.

Want to see how we’ve helped other e-commerce brands scale profitably? Check out our case studies to see real results from stores that moved beyond ad dependency.